Flexible Premium Adjustable Life Insurance

*Disclaimer: Any Information found on website is for education purposes and is not tailored to the investment needs of any specific investor. Investing involves risk, including risk of loss.

In this article we will be going over a “Flexible Premium Adjustable Life Insurance” or also know as “Universal Life Insurance” policy and dissecting it so you can fully understand if you have this type of policy. At the end we will show how we converted our clients policy to our term life insurance and invest the difference philosophy.

How it works:

It’s a financial safety net for your family in the event of your death. Its permanent life insurance that is in force throughout your life when you pay premiums to secure the death benefit your family receives when you die.

This policy does have a combination of Cash Value and life insurance. The Cash Value can be used to pay off your premiums.

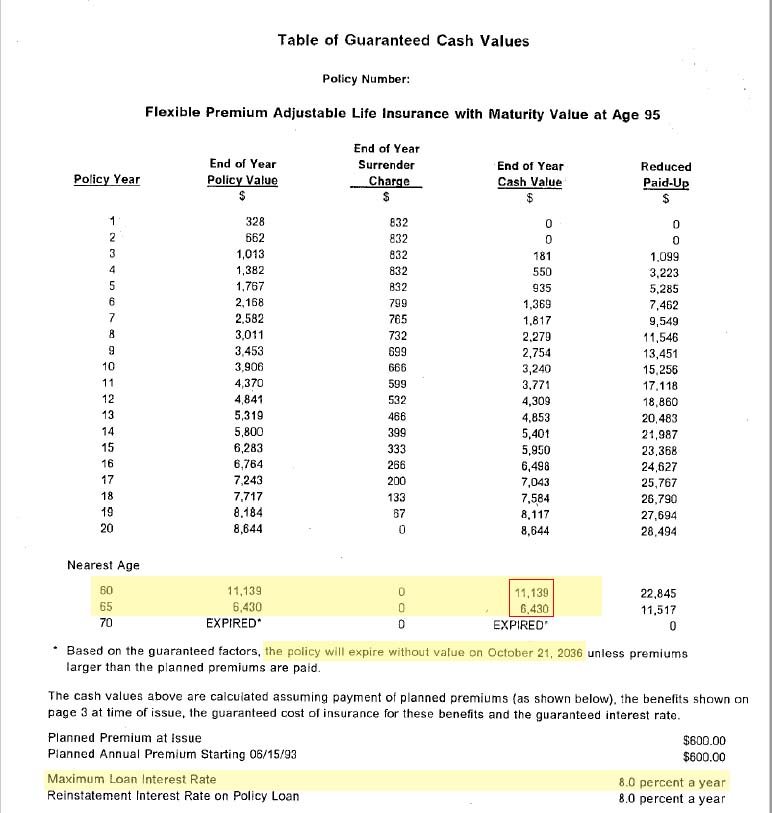

- First scan first page of policy to make sure your policy says “Flexible Premium” or “Universal”

- Next you will skip to the table of “Guaranteed Cash Values”

- Use table of contents if needed

- Take a look at the “End of Year Cash Value” column.

- First thing to notice is that company keeps your savings up to year two (Goes to Agent who sold policy)

- The maximum cash value that the policy obtains is $11,139 when client is 60 years old

- When client turns 65 years old savings drops to $6,430

- Policy expires when client turns 70 years old

- Why does it expire?

- Cost of Insurance is increasing each year due to client getting older

- Planned Premium Annual Premium Starts at $600

- Each year annual premium will increase and to cover difference it will eat out of Cash Value until policy dies

- Policy does state it will expire by year 2036

- Cost of Insurance is increasing each year due to client getting older

- On this policy they receive an interest rate of 4.5% for cash value

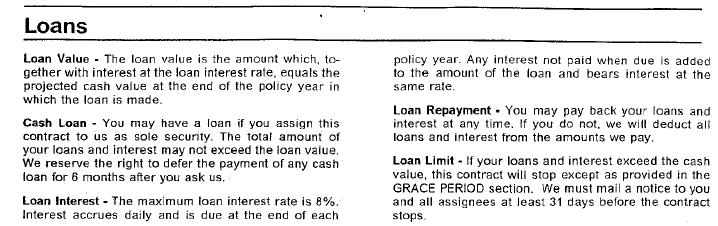

- Need to ask 6 months in advance for a loan and they charge 8% for a loan

- Need to pay back the loan

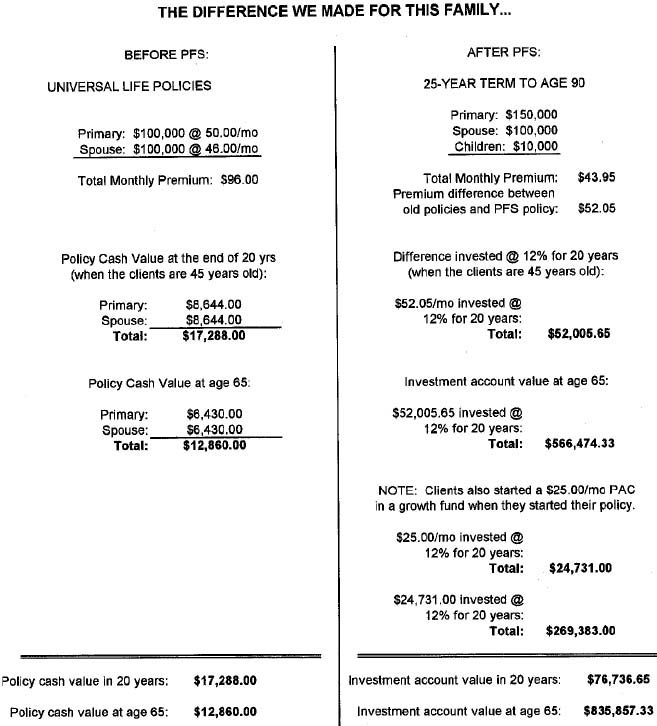

Now Below is what we did for this family

If you have a similar policy and would like us to review. Please contact us.