Group Life Insurance - What you need to know

*Disclaimer: Any Information found on website is for education purposes and is not tailored to the investment needs of any specific investor. Investing involves risk, including risk of loss.

We will be explaining what group life insurance is and will be showing an example certificate of what to look for. If you don’t have the certificate you can ask for a copy from Human Resources or look at your pay stub which will have what you are paying.

In summary group life insurance is provided by an employer to a group of employees. As a whole the group of employees are approved and premium (price per month for coverage) is based on data collected from group. The employee is given a certificate of coverage; employer has control of the policy.

It’s usually given to an employee as part of a basic benefit package that is usually free to the employee.

Coverage provided is one to two times salary of the employee which is not enough.

How much life insurance do i need?

To find out how much you need we use DIME which is a simple equation which sums up Debt, Income, Mortgage, and Expenses. For example:

- Debt ($40K)

- Income ($55K)

- Mortgage ($350K)

- Expenses ($50K)

Grand total of coverage needed = $495K

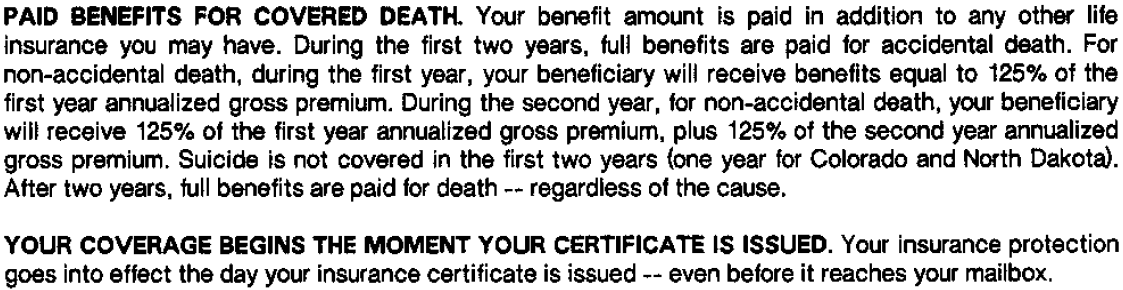

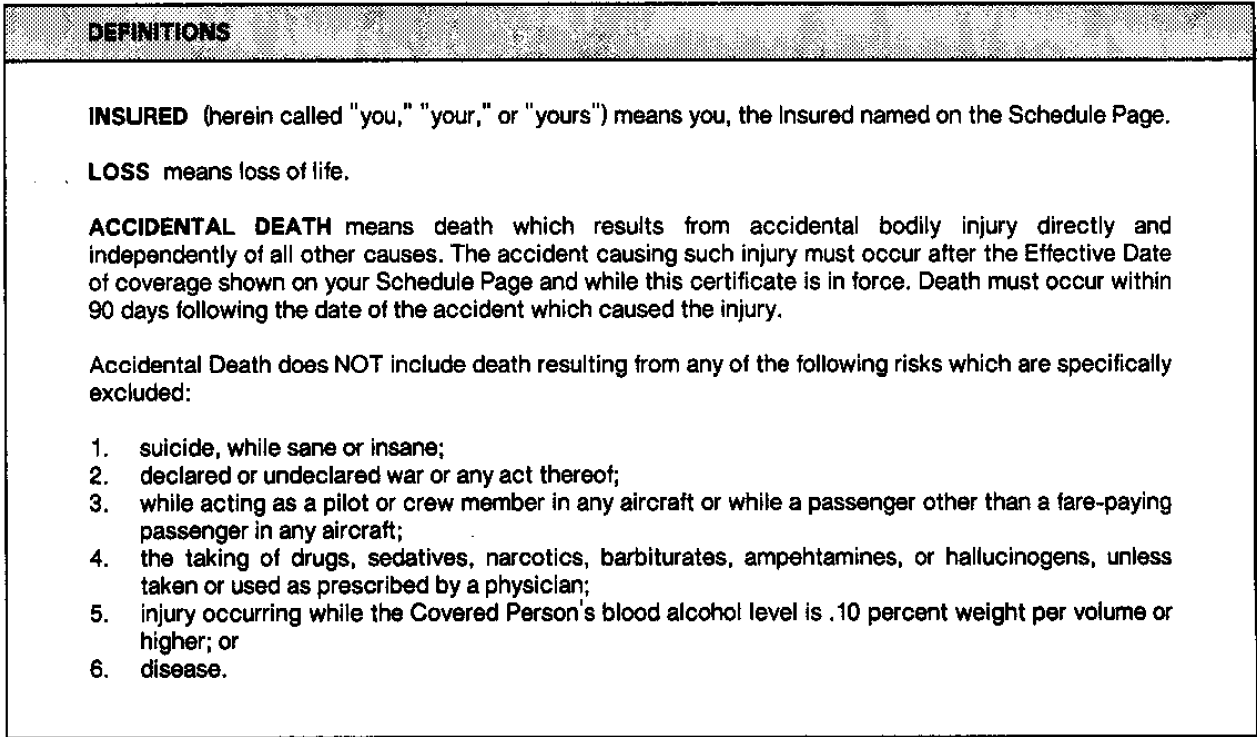

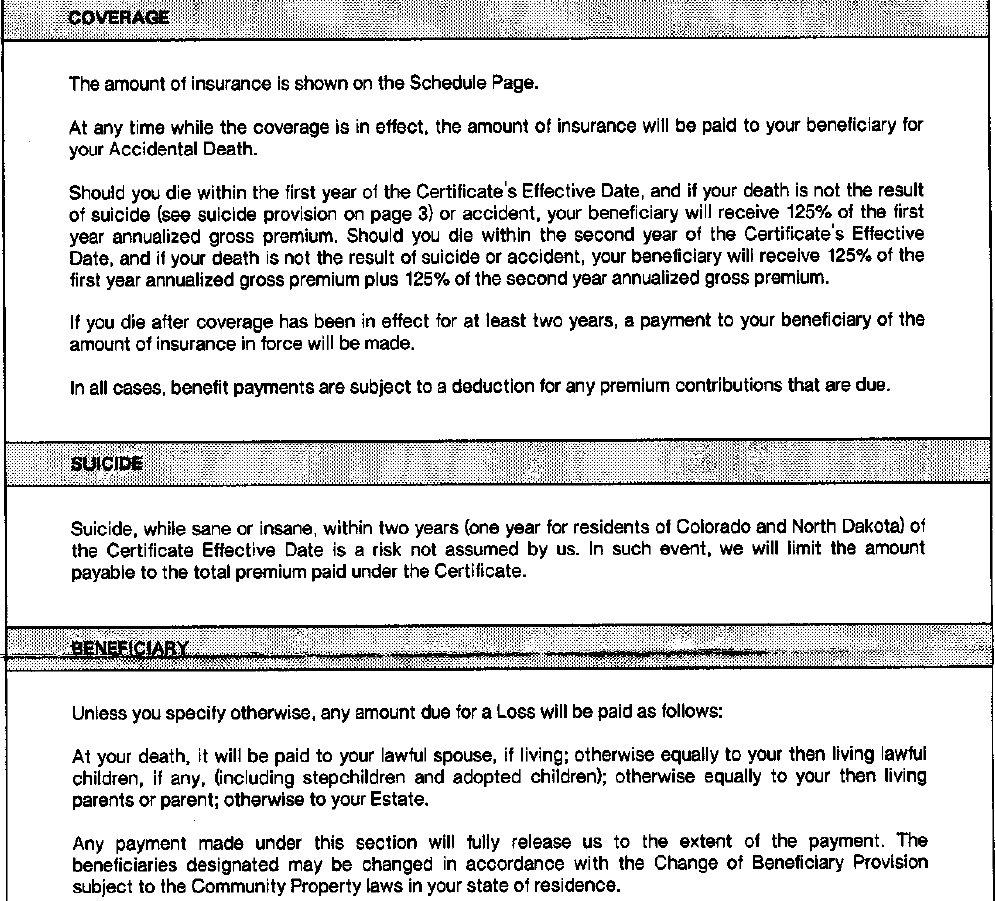

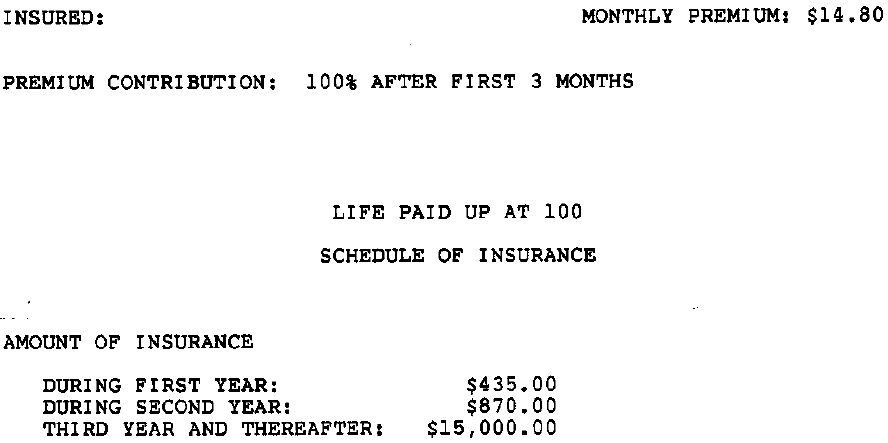

Here is an example of a Group Life Insurance with an Accidental Death and Dismemberment Certificate.

In summary this policy only covers accidental death and it will be paid to the beneficiary only if insured passes away from an accidental death within 90 days. The only catch is that someone needs to provide proof of death and cause of death within 90 days after death.

If you are not sure what you have. Feel free to email us or fill out the form below and we will be glad to help you and your family. To ensure you have a policy that you can control and know how it works.