Whole Life Insurance

*Disclaimer: Any Information found on website is for education purposes and is not tailored to the investment needs of any specific investor. Investing involves risk, including risk of loss.

Above videos are supplementary to the topic i will be covering below and he’s not affiliated with Protect Assets Today nor is this being monetized.

In this article we will be going over a Whole Life Insurance policy and dissecting it so you can fully understand if you have this type of policy.

According to the article The ABCs of Making Wealth by Denis Cauvier life insurance should be purchased for protection and its not an investment. Many people purchase whole life insurance as an investment and in their opinion, “its one of the greatest Wealth Robbers”. Goal is obtain the maximum life protect (Term insurance) at lowest price, while investing money as much money per month in best investment vehicles (Real Estate, Roth IRA, IRA, Mutual Funds)

Draw Backs to whole life:

- If you die, your beneficiary cannot collect both the face amount and cash value of policy (most are unaware of this)

- Expensive for amount of coverage provided and you may be under insured

- You are a middle man and company uses cash value as a pool for bigger investments

- in order to get money out of a whole life policy you must either surrender the policy or borrow it from the policy and can lapse policy

How much life insurance do i need?

To find out how much you need we use DIME which is a simple equation which sums up Debt, Income, Mortgage, and Expenses. For example:

- Debt ($40K)

- Income ($55K)

- Mortgage ($350K)

- Expenses ($50K)

Grand total of coverage needed = $495K

How Whole life insurance works:

It’s a financial safety net for your family in the event of the loss of a bread winners earnings in the event of death. Its permanent life insurance that is in force throughout your life when you pay premiums to secure the death benefit your family receives when you die.

This policy does have a combination of Cash Value and life insurance can offer dividends (not guaranteed). The Cash Value can be used to pay off your premiums.

- First scan first page of policy to make sure your policy says “Whole Life”

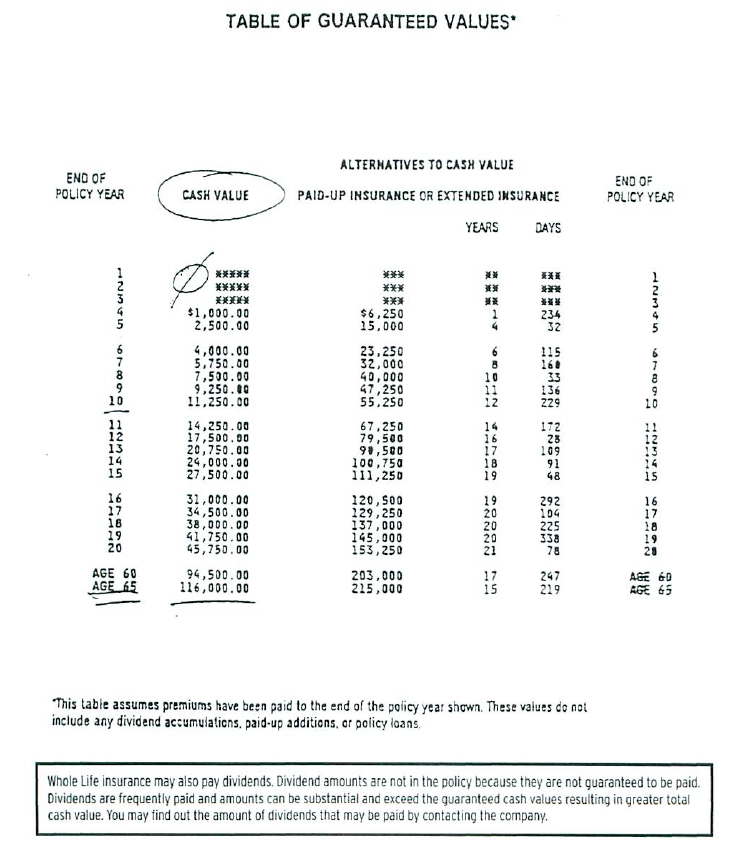

- Next you will skip to the table of “Guaranteed Cash Values”

- Use table of contents if needed

- Take a look at the “End of Year Cash Value” column.

- First thing to notice is that company keeps your savings up to year four (Goes to Agent who sold policy)

- The maximum cash value that the policy obtains is $100,500 when client is 65 years old

- Cost of Insurance stays constant

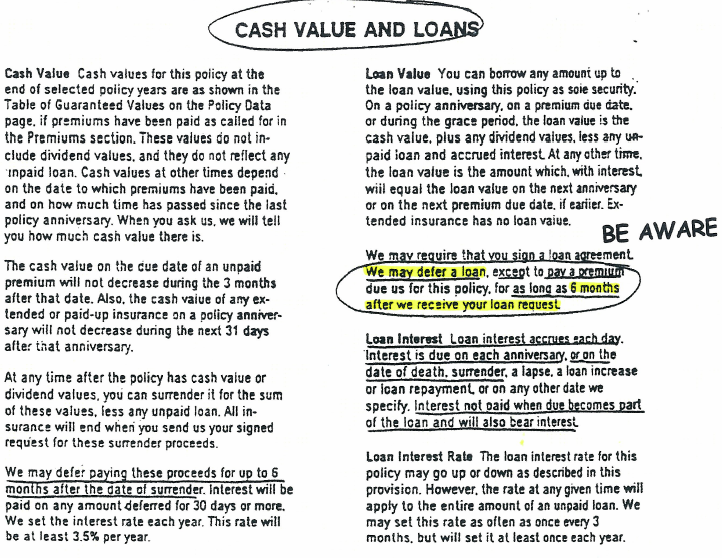

- On this policy they receive an interest rate of 3.5% per year for cash value

- Need to ask 6 months in advance for a loan and they may reject and they charge 4% to 8% for a loan (sample i have doesn’t display it)

- Need to pay back the loan and

- loan interest accrues each day

- Once no money in cash value policy will terminate

- In the event you were to pass away during time of contract you will receive the death benefit minus any loans, partial surrenders.

- Cheat sheet of all types of life insurance