Online Red Flags for Investors

*Disclaimer: Any Information found on website is for education purposes and is not tailored to the investment needs of any specific investor. Investing involves risk, including risk of loss.

When it comes to online investments its important to know these red flags to avoid being caught in investment Fraud.

Investment Fraud is a significant problem in the United States and at least 10% of investors will be a victim (Understanding and combating Investment Fraud). Lets avoid being the 10% by following the top 7 online flags.

Top 7 Online Flags

- Promises of high returns with no risk. Many online scams will promise unreasonable high short-term profits. Agent or seller can never guarantee a profit. Keep in mind that you can’t have a high reward without a high risk.

- Offshore operations. Many scams are headquartered offshore, which makes it difficult to shutdown the scam and recover investors’ funds. For instance, I’m sure we all have gotten a call or text from a stranger requesting a service or selling a product. If they sound like they are not American or request something that is out of the norm related to your industry. Beware!

- E-currency sites. If investors have to open an e-currency account to transfer money, use caution. Caution – These sites may not be regulated and scammers use them to cover up money trails.

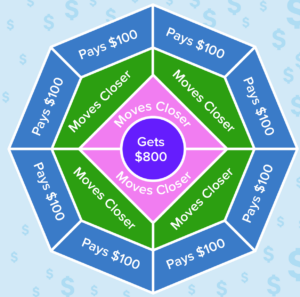

- Recruit Friends. Most cons will offer bonuses if investors recruit their friends into the scheme. A great example of this is Susu and it involved x amount of people putting in money and winner receives a grand prize. This spread around during corona virus (COVID-19) in 2020.

- Professional websites with little to no information. Anyone can put up a website. The Website may look professional but offer no information about the company’s management, location, or details about the investment. A great way to verify if its fake is to reverse search any of the images of management and if they are stock photos or linked to another website. Stay Away! To learn more about how to determine if a website is fake click here.

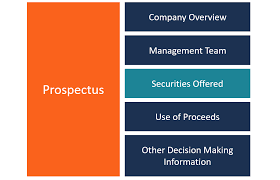

- No written Information. Online scam promoters might fail to provide a prospectus or other form of written information detailing the risks of the investment and procedures to get the investor’s money out.

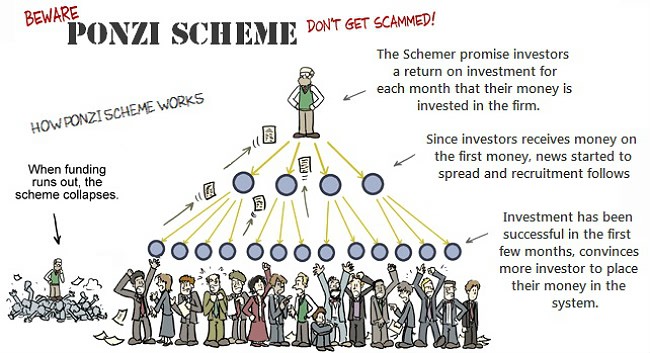

- Testimonials from other group members. Scam artists frequently pay out high returns to early investors using money from later arrivals. This is also referred as a Ponzi scheme. Fraud aimed at groups of people who share similar interests is called affinity fraud.

Hopefully now you have a better understanding on some red flags to look out for online investments.

If your looking for investment advise services, life insurance or other services. Give us a call or fill out the form bellow for a free Consultation.