*Disclaimer: Any Information found on website is for education purposes and is not tailored to the investment needs of any specific investor. Investing involves risk, including risk of loss.

In the world of investments its important to know what you are getting into before you make a commitment from purchasing on your own or by an investment professional. Goal of this article is to teach you what is a bond, how is it used, what are some advantages and disadvantages plus risks involved.

- What is a bond?

A bond is a debt security that represents money borrowed by corporations, the federal government, or local governments (municipalities) from investors. A bond can also be referred as a loan in which the entity who borrowed money from investors is in debt to pay back the investors the principle plus interest when the bond matures.

When an investor purchases a bond, they have no ownership/equity in the entity and are simply creditors of the borrowing entity.

Maturity types

Each bond has its own maturity date. This is simply the date the investor receives the loan principle back. Its common for maturities to be in the range of 5-30 years, some can be shorter or longer. These are the three types of maturities:

- Term bond – is structured so that the principle of the whole issue matures at the end of the term. The entire principle is repaid at one time.

- Serial bond – schedules portions of the principle to mature at intervals over a period of years until the entire balance has been repaid.

- Balloon bond – Has a maturity combination of both serial and term maturities. The issuer repays part of the bond’s principle before the final maturity date, but pays off the major portion of the bond at maturity.

Coupons and Accrued Interest

A coupon represents the interest rate the issuer has agreed to pay the investor. In the past bonds where issued with interest coupons attached that the investor would detach and turn in to receive the interest payments. The interest rate the bond pays is referred as coupon rate. Coupon rate can also be referred as stated yield or nominal yield. Coupon rate is calculated from the bond’s par value (stated a percentage of par). Par value is also referred as face value for a bond, and is normally $1,000 per bond and thats the price it will be redeemed at when it matures. For instance, a bond with a 7% coupon is paying $70 in interest per year (7% x $1,000 par value = $70).

Now in regards to accrued interest, what if the bond trades during coupon payments? The buyer (new owner) must pay the seller (old owner) the amount of interest earned to date at the time of settlement. This pretty much means the new owner gets paid the full coupon on the next payment cycle.

Pricing

Once a bond trades in the secondary market, it can trade at a price of par, a premium to par, or a discount to par. Lets assume at par a bond equals $1,000. Premium to par would be more than $1,000. Discount to par will be less than $1,000. A bonds price is measured in points and each point equals 1% of its face value or $10. For instance, a bond trading at 80 is worth $800.

What affects price of bonds?

The price of a bond can be affected by supply and demand from the market. Now since a bond is a debt instrument, they are sensitive to changes in market interest rates. All this means is that the bond price will rise and fall as interest rates fluctuate.

Generally, bond prices have an inverse relationship to interest rates. For instance, if interest rates go up , bond prices for those trading in the secondary markets will go down. Its the opposite if interest rates fall down. Think about it this way: if a bond in the market was offered at 6%, wouldn’t a bond currently paying 8% look more attractive? It sure will, and as investors were attracted to it since price will go up.

Yields

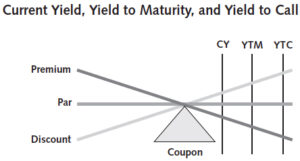

As was noted earlier a bond can be traded at prices other than par and is taken into consideration when calculating a bond’s overall yield. A bond’s yield can be locked at as:

- Nominal Yield — coupon, nominal, or stated yield is set at the time the bond is issued.

- Current Yield (CY) — CY measures a bond’s annual coupon payment (interest) relative to its market price, as shown in equation

- annual coupon payment ÷ market price = current yield

- Yield to Maturity (YTM) — YTM reflects the annualized return of the bond if held to maturity. When calculating YTM, the bondholder takes into account the difference between the price that was paid for a bond and value received when bond matures.

- In order for investor to make money at maturity, bond must be purchased at a discount

- In order for the investor to lose money at maturity, bond must be purchased at a premium.

- Yield to Call (YTC) — Some bonds can be issued with a call feature. When a bond has this feature it allows it to be redeemed before maturity by the issuer’s choice. When this feature is called, the investor receives the principle back sooner than anticipated (before maturity).

Yields are measured in basis points and is equal to 1/100 of 1%. A full percentage point is made up of 100 basis points (bps). DON’T CONFUSE BASIS POINTS WITH POINTS. A point is a measurement of the change in a bond’s price, which equals 1% of face value, or $10 per bond. YTM can be referred as a bond’s basis. For instance, a bond trading at a 5.83 basis means the bond has a YTM of 5.83%.

Features

Bonds can be issued with different types of features. These are the most common:

- Call feature — As noted earlier, this feature allows an issuer to call in a bond before maturity. An issuer will generally do this when interest rates are falling. Lets say the old bond has an interest of 6% and the current interest of new bonds has fallen to 4%. This allows them to turn in the 6% and issue a new one for 4% that allows paying at a lower interest rate. This feature benefits the issuer.

- Put feature — This feature is the opposite of a call feature. This simply allows the investor to turn in the bond when interest rates rise on a bond. For instance, why receive 4% when you can receive 8% when you put back to the issuer.

- Convertible feature — Simply allows the bond to be converted to shares of common stock. This gives the investor the opportunity to exchange a debt instrument for one that gives the investor ownership rights.

When features benefit the issuer, bond is issued with a higher coupon rate of interest to make the bond attractive to new investors. Now when feature benefit the bondholder, the issuer will pay a lower coupon rate of interest.

Over all this is how a bond works and should give a basic understanding of this type of debt instrument. Is this a proper investment for you? Contact a local investment advisor representative or broker to see if a bond matches your investment objective, risk factor, etc.